Importance of Puebla in the production and export of light vehicles in Mexico in 2025

In 2025, Puebla contributed approximately 12.27% of the national production of light vehicles, maintaining a key role in the industry.

The state also contributed 12.21% of Mexican exports, being a strategic point for international vehicle marketing.

Although the country faced a general decline in production and exports, Puebla continued to be a relevant industrial engine with large installed capacity.

Puebla contributes approximately 12.27% of national production and 12.21% of light vehicle exports in 2025.

Between January and November 2025, Puebla produced more than 455 thousand light vehicles, strengthening its presence in the Mexican automotive sector.

Its substantial contribution to the national total confirms the importance of its plants and the relevance of this industry in the region.

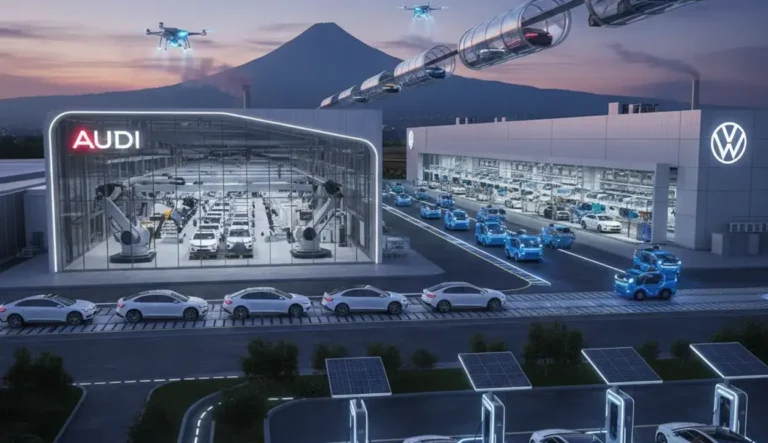

The Audi and Volkswagen plants are primarily responsible for leadership and industrial activity in the state.

The Audi and Volkswagen factories in Puebla lead production, being the main driver of local and regional automotive development.

These facilities not only produce vehicles, but also encourage innovation and job creation in the state.

Despite a general drop in exports, Puebla maintains a vital strategic center with significant installed capacity.

Exports in Puebla decreased by about 13% in 2025 due to factors such as tariffs and blockades, affecting shipments mainly to the US.

However, Puebla retains its strategic role due to its infrastructure, installed capacity and its logistical location for the automotive industry.

Promotion of Audi and Volkswagen in the recovery of the automotive sector in Puebla during 2025

In 2025, Audi and Volkswagen continue to receive state subsidies to strengthen supply chains and local production in Puebla.

The government promotes investments that promote employment and consolidate Puebla as a strategic hub for the Mexican automotive sector.

Although exports fall, investments and subsidies aim to maintain competitiveness and industrial modernization.

Volume of continuous investment and state subsidies aimed at strengthening local production and supply chains.

Volkswagen and Audi receive subsidies that reach more than 200 million pesos in 2025, conditional on the strengthening of local suppliers.

The governor has promoted efforts for new investments and projects in electromobility and digitalization in both plants.

Innovations and sustainability in production

Volkswagen inaugurated the first 100% electric paint plant in Mexico, with more than 93% of energy consumption coming from renewable sources.

Companies advance in industry 4.0, digitalization and technical training to prepare Puebla in electric mobility and clean technologies.

Volkswagen inaugurated the first 100% electric paint plant in Mexico in 2025, reflecting commitment to sustainability.

Despite falls in exports, both manufacturers show efforts to maintain competitiveness and generate jobs.

Audi and Volkswagen strengthen their value chains by bringing together more than 200 suppliers to ensure efficient and sustainable production.

The sector plans to generate approximately 6 thousand new jobs in 2025, focused on innovation and expansion of the local industry.

Overview of automotive production and export nationwide in 2025

As of November 2025, Mexico produced nearly 3.7 million light vehicles, with an annual drop of 1.5% compared to 2024.

Exports totaled around 3.16 million units, registering a decrease of 1.6%, despite remaining at historically high levels.

These data show a moderate adjustment in the automotive sector, marked by global and commercial factors that impact the national industry.

Light vehicle production in Mexico registered a slight annual drop of 1.5%, with a total of 3.7 million units produced until November.

Cumulative production through November saw its first drop in several years, reflecting disruptions to the global supply chain.

In November, the decline was more pronounced, with an annual contraction of 8.4%, impacting the monthly productive dynamics of the sector.

Exports also decreased by 1.6%, remaining among the highest historical levels, but with impacts of interruptions in the global chain.

Exports fell mainly due to tariffs and logistical problems in the trade relationship with the United States, the main destination.

The decrease in November was 3.5%, highlighting the sensitivity of the Mexican market to tensions in international trade.

The market faces challenges due to tariffs, saturation of installed capacity and regulatory changes such as the review of the T-MEC.

Tariffs imposed by the US cause additional costs and put pressure on the competitiveness of the Mexican automotive sector in 2025.

Furthermore, plant saturation and possible changes in the T-MEC generate uncertainty, affecting investment plans and future production.

Comparison of Puebla with other important automotive regions such as Bajío and San Luis Potosí

In 2025, Puebla suffered a sharp drop in its automotive production, with a decrease of 27.9% until October, affected by external factors.

Puebla's exports also decreased by 13%, impacted by logistical problems and tariff policy with the United States.

Despite being a relevant pole, Puebla showed a late recovery in November, which failed to reverse the negative annual trend.

Puebla registered a drop in production of 27.9% and in exports of 13% in 2025, affected by tariff policy and logistical problems.

Volkswagen and Audi, the main manufacturers in Puebla, had significant reductions in exports, with VW falling 17.2%.

The combination of commercial uncertainties and challenges in the supply chain strongly impacted the performance of the sector in Puebla.

El Bajío and San Luis Potosí maintain a more stable performance with fewer falls and greater investment, being the main automotive hubs in the country.

These regions recorded less pronounced falls and continue to attract investments that strengthen their production and exports.

San Luis Potosí and Bajío, with key plants, consolidate their position on the Mexican automotive map despite the global challenges of the sector.

Perspectives, challenges and opportunities for the Mexican automotive industry in 2025 and beyond

In 2025, the Mexican automotive industry faces challenges due to tariffs, revision of the T-MEC and slow economic growth, which affect its competitiveness.

Electrification and the adoption of advanced technologies open key opportunities to strengthen production and diversify international markets.

A moderate recovery is expected towards 2026, with the potential to consolidate Mexico as a leader in electric vehicles and sustainable mobility.